Liberty HealthShare Review: How We Handle Our Healthcare in 2021

This article may contain references to some of our advertising partners. Should you click on these links, we may be compensated. For more about our advertising policies, read our full disclosure statement here.

Editor’s Note: This Liberty HealthShare review was last updated in November 2020. It is an accurate portrayal of our past experience as Liberty HealthShare members. Although we were happy with Liberty Healthshare for years, as of 2022, we are no longer members of Liberty Healthshare.

Open enrollment for health insurance is back, and you can count me as underwhelmed. If you’re stuck searching for an affordable plan on the open market – news flash – the options ain’t pretty.

As self-employed individuals, our family has been dealing with the effects of the Affordable Care Act since it was fully implemented in 2014. Every year, I search for affordable health insurance options in my area’s health insurance marketplace. Every year, I come away feeling more disappointed than the last.

Depending on where you live, premiums continue to increase, benefits continue to be slashed, and many insurers have pulled out of the marketplace altogether. In many places, including my own area, potential customers have just one or two insurers available to them. Faced with huge monthly premiums, high deductibles, and restricted networks, it’s safe to say that families around the country are feeling the pinch.

Like many of you, we found ourselves in a difficult situation. That’s when we discovered medical cost sharing ministries, including Liberty HealthShare. Sure, it is an imperfect solution to a difficult problem, but we’ve been using LHS for about seven years. During that time, we’ve had children break bones, undergone a few surgeries, and more. We will continue using Liberty HealthShare to meet our needs in 2021.

With this Liberty HealthShare review, I hope to help others find a solution to this difficult financial challenge. I’ll explain why we chose Liberty HealthShare, how they’ve handled our personal claims, and cover the pros and cons of signing up. I will also attempt to answer some of the most common questions asked about Liberty HealthShare and explain the various sharing options available to members.

Let’s get started!

- Liberty HealthShare: At a Glance

- What is Liberty HealthShare?

- Liberty HealthShare Programs and Pricing

- Submitting Expenses Eligible for Sharing

- Our Experience with Liberty HealthShare

- Liberty HealthShare Advantages

- Liberty HealthShare Disadvantages

- Who Should Consider Liberty HealthShare?

- Who Should Avoid Joining Liberty HealthShare?

- Liberty HealthShare Review: Frequently Asked Questions

- Liberty Healthshare Review: The Bottom Line

Liberty HealthShare: At a Glance

Healthcare sharing ministry

- In existence since 1995

- Members share medical expenses with other members

- 4 different sharing plans to meet member needs

- Monthly sharing contributions from $199-$675 per month

- Annual unshared amounts (excluding Liberty Select Plan) – $1,000 single, $1,750 couple, $2,250 family

- Up to $1,000,000 shareable per incident (depending on plan)

- Choose your own doctor; no networks

What is Liberty HealthShare?

Liberty HealthShare is a healthcare sharing ministry whose members share medical expenses. Members pay a monthly “sharing” contribution which pays for the medical expenses of other members. Then, when they have needs, they first must meet an “annual unshared amount” (similar to a deductible) before their expenses are eligible for sharing.

Keep in mind, this is not health insurance nor are you protected by the same insurance rules and regulations that traditional health insurance provides. The don’t simply use different vocabulary; a sharing program is modeled differently.

As with other healthcare sharing groups, Liberty HealthShare members agree to pay for medical expenses by sharing the costs with other members according to the group’s guidelines. While not ideal, for our situation, it has easily been the most affordable healthcare option at our disposal.

Liberty HealthShare is also a faith-based community. At the time of this writing, this medical cost sharing ministry has well over 200,000 members.

Liberty HealthShare: How It Works

Unlike the ACA-approved health insurance plans, Liberty HealthShare and other Christian sharing ministries don’t have to accept everyone who applies. (Again, this is not insurance.) They are not required to accept people regardless of pre-existing conditions and they don’t take smokers.

That doesn’t mean you will never be accepted if you have pre-existing conditions. Those conditions just may not be eligible for sharing right away. Also if you have a chronic health condition, or are otherwise unhealthy due to weight or some other condition, you may be asked to join their provisional program.

In my opinion, this is one of the biggest drawbacks of sharing plans. On the flip side, not accepting those with existing health problems and “risky” lifestyles does help to keep costs down.

With that said, even if you have some of those conditions all is not lost. If you’re serious about becoming healthier, you may still be eligible to join under Liberty’s provisional membership program called HealthTrac™. This is a “health coaching” option, and we’ll talk a more about this in a bit!

Liberty HealthShare Programs and Pricing

Liberty HealthShare now offers four different levels of sharing. I’ll explain the one my family chose in a minute, but let’s first take a look at all three.

In addition to the monthly share contribution, keep in mind that members are also required to pay membership dues. The initial $125 fee is added to your first month’s sharing contribution and is reduced to just $75 after your first year. That’s really not much but it’s still worth mentioning.I’ll explain the one my family chose in a minute, but let’s first take a look at all four.

| Monthly Share Amount | Annual Unshared Amount (AUA) | |

|---|---|---|

| Single | $399 | $1,000 |

| Couple | $499 | $1,750 |

| Family | $675 | $2,250 |

- $1,000,000 shareable per incident after Annual Unshared Amount (AUA)

- Access to SavNet discounts on vision, dental, hearing, and chiropractic

- Prescription savings plan through HealthShareRX

- Access to Liberty TeleHealth virtual healthcare app and web portal

Liberty Complete is the most comprehensive of the programs. With this option, a family of four will pay $675 per month while couples and singles pay even less.

On this program, members share costs up to $1,000,000 per incident or illness based on the guidelines after meeting the “annual unshared amount.” Annual unshared amounts are: $2,250 per family, $1,750 for a couple, or $1,000 for a single member.

| | Monthly Share Amount | Annual Unshared Amount (AUA) |

|---|---|---|

| Single | $374 | $1,000 |

| Couple | $474 | $1,750 |

| Family | $624 | $2,250 |

- $125,000 shareable per incident after Annual Unshared Amount (AUA)

- Access to SavNet discounts on vision, dental, hearing, and chiropractic

- Prescription savings plan through HealthShareRX

- Access to Liberty TeleHealth virtual healthcare app and web portal

Liberty Plus costs slightly less each month but offers a significantly lower level of sharing. A family of four would pay $624 per month with couples and singles paying even less.

The same annual unshared amounts apply ($2,250 per family, $1,750 for a couple, or $1,000 for a single member). With this program, however, sharing is limited to just $125,000 per incident or illness.

| | Monthly Share Amount | Annual Unshared Amount (AUA) |

|---|---|---|

| Single | $349 | $1,000 |

| Couple | $449 | $1,750 |

| Family | $599 | $2,250 |

- 70% of eligible medical bills shared (up to $125,000) after Annual Unshared Amount (AUA)

- Includes physician, emergency room, urgent care, clinic, inpatient/outpatient hospital treatment

- Prescription savings plan through HealthShareRX

- Access to Liberty TeleHealth virtual healthcare app and web portal

With the Liberty Share option, a family of four would pay $599 per month. Couples and singles still pay less, and the annual deductibles stay the same as the previously mentioned plans.

The biggest difference with the Liberty Share option is the way that expenses are handled. Rather than sharing 100% of costs after meeting an annual unshared amount, with this option, medical expenses are shared at only 70% per incident. Sharing is also capped at $125,000 per incident, as per the guidelines.

| | Monthly Share Amount | Annual Unshared Amount (AUA) |

|---|---|---|

| Single | $199 | $6,000 |

| Couple | $299 | $12,000 |

| Family | $399 | $15,000 |

- $500,000 sharable per incident after Annual Unshared Amount (AUA)

- Eligible wellness screenings sharable up to $400 per membership year (not subject to AUA)

- Excludes maternity

- Prescription savings plan through HealthShareRX

- Access to Liberty TeleHealth virtual healthcare app and web portal

Liberty Select is the newest and least expensive option offered by Liberty HealthShare. Although members will only pay between $199-$399 a month, the Annual Unshared Amounts are much higher. Single members have an AUA of $6,000, couples are at $12,000, and families have a $15,000 AUA.

Members should also keep in mind that, even with high AUAs, this option only allows for $500,000 in shareable expenses after you meet the AUA. Also of note, maternity expenses are not eligible for sharing with Liberty Select.

Submitting Expenses Eligible for Sharing

When it comes to submitting medical expenses, Liberty HealthShare (like other healthcare sharing ministries) may require a little more work on your part. In fact, if may mean taking significantly more action and control over your medical expenses than you are used to.

This is important, so pay attention here: When you use a healthcare sharing ministry, YOU are responsible for making sure your medical bills are submitted. This may require a few phone calls.

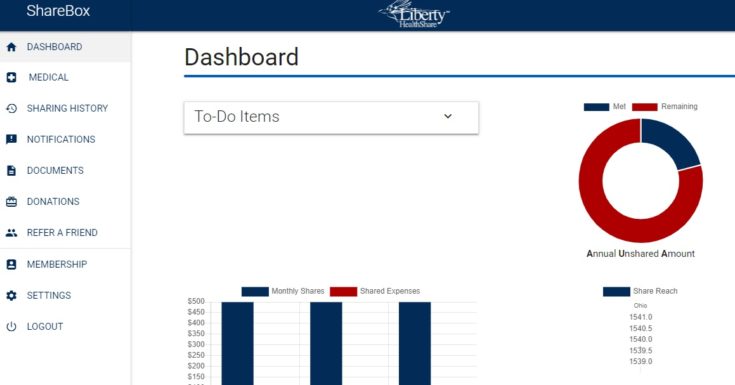

In many cases, your healthcare provider will submit bills directly to Liberty HealthShare for you. Other times, you will need to scan the bills and upload them into the payment system yourself. LHS makes this easy. Simply log into your personal account/dashboard and add your bills through the “Medical” tab.

Personally, I don’t mind monitoring our healthcare bills myself. I like to keep our spending in check anyway, and it’s super easy to scan and submit bills through the website.

On the flip side, I appreciate it when our doctor’s office takes care of this task for us. When we first joined, I would say this responsibility fell us roughly 50 percent of the time. Now that many doctors offices are familiar with patients using cost sharing programs, we rarely need to submit our own bills. Remember, though, it is always your responsibility to check that they have been submitted properly.

With that being said, here’s what my Liberty HealthShare “inbox” looks like:

To see which bills have been submitted, when each was paid, and how much your responsibility might be, simply click on the “Medical” tab in the left menu. There, you’ll find a list of everything you need.

Other than how bills are submitted and the fact that healthcare sharing ministries can be picky about who they accept, the process is very familiar. For example, with most Liberty HealthShare plans, annual wellness visits are included (see the guidelines for details.) While it isn’t always necessary, that concept itself saves us around $600 per year.

Like I mentioned earlier, we also have an “annual unshared amount” that is similar to a health insurance deductible. After we meet that unshared amount, 100% of our costs are shared by the members – up to $1 million dollars per incident, based on the guidelines.

Our Experience with Liberty HealthShare

Now that you know about the Liberty HealthShare plans and options, I thought it might be helpful to learn how my family decided on LHS in the first place.

Shortly after the Patient Protection and Affordable Care Act (PPACA) was rolled out, my family was faced with a near impossible decision. Our old health insurance plan, which cost $393 per month and came with an $11,000 family deductible, was being cancelled because it didn’t meet ACA requirements. Yet, the new Obamacare plans cost more than twice as much AND came with even higher family deductibles to boot!

It quickly became clear that we needed to opt out of the ACA completely. Still we needed a solution to help us cover the cost of catastrophic medical expenses.

After a few months of digging, I discovered how some other families were planning for unforeseen medical bills. The answer: Healthcare sharing ministries. After some serious comparing several healthcare sharing ministries, my family joined Liberty HealthShare in January of 2014.

I wanted to write a Liberty HealthShare review right away, but the first few years were pretty uneventful. Aside from our regular annual visits, none of us went to the doctor. So, I didn’t have a great idea of whether the program was going to work or not.

Fast forward to today, and we’ve been with Liberty HealthShare for about seven years. We’ve all of us seen the doctor and have even had a few procedures done – including some major surgeries. Now that we have some real claims history to report, a Liberty HealthShare review makes more sense.

Dealing with Major Surgeries

In 2018, we experienced our first major medical need as members of Liberty HealthShare. That summer, my seven-year-old daughter broke her arm. She ended up having surgery at our local children’s hospital, which meant over she racked up over $30,000 in medical bills. (Side note: The children’s hospital would not have been covered under the Bronze ACA plans available in our area.)

Thankfully, Liberty HealthShare and their members helped us share the cost of those bills exactly as we planned.

Now, that’s not to say that everything went perfectly. The process itself was not particularly smooth.

We spent several hours following up with both LHS and doctor’s offices to get these bills paid. Over the course of about ten months, we made multiple calls and sent around a dozen emails. While it was a pain, Liberty ultimately covered their portion of the bills.

For us, the time and hassle spent on these bills was worth it. Because we save thousands on our healthcare through Liberty, we’re willing to put in some additional “leg work” to get our medical bills shared. This is something you should keep in mind before choosing Liberty HealthShare for your healthcare needs.

Since then, in our experience, the process has improved considerably. Our other daughter broke her arm in 2020. This time, wee were assigned a personal representative to handle our account. Things went much smoother, and it has been our experience that many of the kinks that were present before have now been worked out.

Liberty HealthShare Advantages

- Low annual unshared amounts: With all Liberty HealthShare plans, your “annual unshared amount” is limited to $2,250 per year for a family, $1,750 for a couple, or $1,000 for singles.

- Know where your healthcare dollars are going: Since healthcare sharing ministries don’t share costs for certain procedures that the group finds “morally objectionable,” you can rest assured your dollars are being spent on healthcare procedures you agree with.

- You can see any doctor you want: Liberty HealthShare lets you see any doctor of your choosing. All they ask is that you shop around and negotiate for the best rates.

- Share actual costs: Liberty HealthShare keeps their administrative costs low. A small percentage of sharing dollars are spent on administrative expenses as they examine costs up front. Your sharing dollars are used to pay for the actual medical costs incurred by others in the community.

- Health consciousness: Because Liberty HealthShare members tend to live healthy lifestyles, their costs are typically less. Liberty emphasizes spiritual principles of wellness, health and prevention. Health conscious people tend to have fewer bills, lower costs, and more rapid recoveries.

Liberty HealthShare Disadvantages

- You may not qualify: If you smoke, are obese, or have a chronic health condition, you may not qualify for a healthcare sharing ministry. However, if you are committed to improving your health, you may qualify for HealthTrac™. This is a health coaching program designed to improve your health and may allow you to become a member.

- This is a faith-based community. These programs are faith-based organizations. You must hold similar beliefs to qualify to participate.

- You may not contribute to a Health Savings Account (HSA). Unfortunately, since medical cost sharing programs are not health insurance, you are not allowed to contribute tax-free money to a Health Savings Account (HSA).

- You need to monitor your own bills closely. While your doctor’s office may handle your claim for you, you’ll need to monitor your expenses online to make sure they post correctly.

- There are arguments over whether or not your monthly shared amount is deductible if you own a business. Since this is not insurance, some accountants argue you cannot deduct your monthly share amount if you own a business. There is definitely a gray area here.

- Medical cost sharing is not unlimited. Liberty HealthShare members only share costs up to $125,000 or $1,000,000 per illness or incident, based on the group’s guidelines. If you ended up with an incredibly expensive illness or injury, you could potentially blow through that limit fast.

Related: Medi-Share Review – A Christian Healthcare Plan Option

Who Should Consider Liberty HealthShare?

Self-employed business owners – If you are a self-employed owner of a small business, chances are good that your only option for securing health insurance is on the open market. Although it is not “health insurance,” Liberty HealthShare is another option for meeting your family’s healthcare needs in an affordable manner.

Other individuals shopping the healthcare marketplace – Similarly, if you are shopping for a health insurance plan on the open market, are not eligible for subsidies, or don’t like the prices you see, a healthcare sharing ministry could present a possible solution.

Christians wanting to share medical expenses – Liberty HealthShare is a good choice for Christians who are tired of the traditional healthcare system and who, instead, wish to share medical expenses with others hat have similar beliefs.

Who Should Avoid Joining Liberty HealthShare?

Individuals with access to affordable health insurance plans – If you have access to affordable health insurance through work or are eligible for large government subsidies, the added expense of a medical cost sharing program may be unnecessary. (Keep in mind, Liberty HealthShare is not medical insurance.)

People with pre-existing conditions – Because Liberty HealthShare is not medical insurance, they are not required to provide coverage for pre-existing conditions. Those with pre-existing medical conditions may be accepted for membership after a period of time, but the added expense of both a health insurance plan and becoming a medical cost sharing member may not be worth it.

Those unwilling or unable to track their medical expenses – It is important to remember that members are ultimately responsible for tracking (and paying) their medical bills. While LHS can be an affordable way to handle your healthcare, it often requires more work on the member’s part to process medical bills. In some cases, you may even need to wait for reimbursement of certain bills. If you are unable or unwilling to do this, you should probably avoid medical cost sharing programs.

Liberty HealthShare Review: Frequently Asked Questions

Since I first posted this review, I’ve received hundreds of comments, emails, and questions about the program. While I’d definitely recommend you contact Liberty HealthShare with questions specific to your personal situation, here are a few of the most common questions I’ve been asked.

Is Liberty HealthShare the same as health insurance?

No. Liberty HealthShare is not health insurance. It is a medical cost sharing program in which members share healthcare costs between them. We use Liberty HealthShare to plan for unanticipated medical expenses.

Is Liberty HealthShare a scam?

No. It is very real. In our experience, the members of Liberty HealthShare have shared all our medical expenses that were eligible for sharing per our plan guidelines.

Are healthcare sharing ministries a new concept?

No. Healthcare sharing ministries are not new, but rising health insurance costs have definitely made them more popular. Medical cost sharing programs can trace their roots back to the mid-1980s. As a group, Liberty HealthShare’s parent organization (Gospel Light Mennonite Church Medical Aid Plan, Inc.) has been sharing medical costs since 1995.

Do I have to belong to a specific Christian denomination to become a member of Liberty HealthShare?

No. Compared to some medical cost sharing programs, one of the biggest advantages of joining Liberty HealthShare is that you do NOT need to belong to a specific denomination.

While some sharing ministries require you to be a member of an evangelical church and/or get a signed note from your pastor, Liberty HealthShare simply requires that you agree to a statement of beliefs. This statement essentially says that you believe in God, that all people have a right to worship in their own way, and that people have the right to direct their own healthcare decisions free from government interference.

Are there any other lifestyle requirements I need to know about?

Yes. In an effort to keep costs down, Liberty HealthShare members agree to take responsible and reasonable care of their own health. This includes not drinking alcohol excessively, not using tobacco, not abusing illegal drugs or prescription medication, and getting regular exercise.

Wait, are you saying I can’t drink or smoke?

As a member, you agree to not drink excessively or abuse alcohol. If you are a tobacco user, you will be required to join the provisional HealthTrac™ program which adds an additional monthly fee. You are given 6 months to become tobacco free. You will also be required to complete nicotine testing.

Are pre-existing conditions eligible for sharing with Liberty HealthShare?

Eventually. Liberty HealthShare considers pre-existing conditions to be “any condition at the time of enrollment that has evidenced symptoms, or received treatment or medication in the past 24 months.” Pre-existing conditions are not eligible for sharing your first year of membership. From there, they are gradually eligible for more sharing each year until they receive full sharing status during your fourth year of membership.

Do Liberty HealthShare members share dental and vision expenses?

No. Medical cost sharing with Liberty does not extend to dental or vision procedures or expenses. With that said, LHS does partner with the SavNet Health Savings Program to provide discounts for dental, vision, and chiropractic expenses.

Does Liberty HealthShare include sharing for prescriptions?

To keep the cost of prescription drug prices down, Liberty HealthShare members have access to HealthShareRx. The program partners with over 64,000 pharmacies where they can get a 21-day supply of the most common medications for just $5.00. Members can also enjoy savings on long-term maintenance medications with this program.

What if I am denied membership due to health reasons?

If something in your application triggers a denial based on your health, you may be eligible to join the Liberty HealthTrac™ program. This program pairs members with a health coach and helps set realistic goals for improving their health.

A monthly participant fee is required for the HealthTrac™ program and will be dropped upon graduation. While everyone is different, Liberty states that they expect to see improvements in the members health within a year.

Will my doctor accept Liberty HealthShare?

Unlike health insurance plans, Liberty HealthShare does not have networks. You can use the program with any doctor you choose.

Simply inform them that you are part of a medical cost sharing program, show them your card, and have them send bills directly to Liberty HealthShare. (If you have not met your annual sharing amount, you will still be responsible for the total.)

Are there limits on the amount of sharing?

Yes. Members are currently limited to sharing amounts of up to $125,000 or $1,000,000 per incident, depending on the program you select.

Does being a Liberty HealthShare member exempt me from Obamacare tax penalty?

When congress passed the December 2017 tax bill, the Obamacare individual mandate was repealed, effective in 2019.

Can I cancel my Liberty HealthShare membership at any time or am I obligated to stick with the program?

You can cancel your Liberty HealthShare membership at any time and are under no obligation to continue with the program. Keep in mind that you do pay initial membership dues of $125.00 and annual membership dues each year thereafter of $75.00. Liberty HealthShare allows you to join the program for 30 days risk free. If you cancel within your first 30 days, the membership fee will be refunded. However, canceling after the 30-day period results in a forfeiture of your membership dues.

Is there a specific enrollment period or can I join whenever I’m ready?

Unlike Obamacare, you can join Liberty HealthShare at any point during the year.

Liberty Healthshare Review: The Bottom Line

Although I still consider our healthcare options every year, after seven years with Liberty HealthShare, our family continues to remain as members. I’m fairly confident we’re making the right decision. We’re saving money every month, and we get to see any doctor of our choosing. As an added bonus, our Annual Unshared Amount is just $2,250. This greatly reduces the amount of out-of-pocket medical costs we could be responsible for in any given year.

With that said, the process is not perfect. Still, Liberty has eventually shared all of our eligible medical expenses as outlined in our plan. Yes, it took some extra effort on our part. But, for us, the extra effort is more than worth the savings we’ve received.

If you’re considering a healthcare sharing ministry, you should definitely compare Liberty with the other options out there. I liked some other comparable programs, but we chose to go with Liberty HealthShare because we felt that the payments and sharing arrangement made sense for our situation. Finally, if you’re struggling under the weight and expense of unreasonable Obamacare plans, it makes sense to shop around as much as you can.

Have you ever heard of healthcare sharing ministries? Would you join one? Why or why not?

Liberty HealthShare Review

-

Range of Product Offerings

-

Shareable Amounts per Incident

-

Monthly Cost

-

Annual "Unshared" Amounts

-

Customer Service

-

Expense Sharing Process

Overall

Liberty HealthShare Review

Liberty HealthShare is a medical cost sharing program that allows members to share medical expenses with other members. For those who are struggling to find affordable healthcare options, Liberty may be a good choice.

Offering several different plans to meet members financial needs, Liberty HealthShare members pay as little as $199 a month. With most programs, Annual Unshared Amounts range from $1,000 for individuals to $2,250 for families. Depending on the program selected, members may be eligible for medical costs to be shared up to $1M per incident.

Unfortunately, Liberty HealthShare is far from perfect. The process of submitting expenses to be shared can often take months to resolve. Members may end up spending some time and energy tracking those expenses. Still, if you’re struggling and fed up with the expense of healthcare, Liberty HealthShare provides a solid solution to meet your healthcare needs.

Healthcare sharing ministry

Healthcare sharing ministry

This is so interesting to read about Holly. Fortunately we have health care through my husband’s work (he’s retired though!) – for 7 more years and by then my kids will be adults too. It will be interesting to see what happens with health care by then so plans like this are important to know about!

I haven’t read down to see if anyone else ran into this for basic bills but we moved to Liberty healthshare a few years ago to cut some costs and now after three years of paying their monthly “Share” costs and never asking for a single share amount back they discounted a bill as expected and then we find out that they actually have no power to do this with the vendor and won’t back their discounted price that we paid up. Now we are told they only can suggest suggested a discount, so a collection agent has been calling even though every time I call into Libtery they say it will be taken care of. They are the most organized on the surface but I would not recommend them if you actually want it them to be of any basic value in lowering your end price. (this one was $1200 for 4 stitches that was discounted to $400. We paid the discount and now they are going after us for the rest). I would not recommend Liberty and you may not know it until it is too late.

Also, be aware the Essentia Healthcare does not honor Liberty Healthcare and will go for every penny of their highest price.

I have been a member of Liberty Health Share for over five years. Everything was fine until I started having actual medical problems with real medical bills. FOR OVER A YEAR I have been trying to get my medical bills paid. I have the medical providers sending me bills and calling me. I have Liberty giving me the run around. I have had to submit paperwork to The MCS Solution, who are suppose to be intermediaries to get issues resolved. All I get is the run around. Liberty operates JUST LIKE TRADITIONAL INSURANCE COMPANIES. They take your money, make money on your money, and then do whatever they can to avoid paying your claims. I use to be with MediShare and I am going back! LIBERTY HEALTH SHARE is great when you’re not sick, but they are TERRIBLE when things go wrong. So disappointing.

It’s August 1, 2019 and my service date was 11-13-18, 7 1/2 months ago and Liberty Health Share (LHS) still hasn’t paid. I was with Liberty Health Share in 2018 and on average bills were adjusted, then paid in 4 to 5 months. This latest put me in collections and I have 800+ credit scores (or had). I just paid the collection agency this morning and called LHS for about the 12th time on this matter. Today I was told that a check was mailed today directly to me. In a previous matter, the LHS billing rep told me that I had no coverage for lab billing and to just pay it. I later received a letter stating that the bill was adjusted and that my payment was about $600.00 less then what the rep told me to pay. I went back to Kaiser for 2019 and I pay about $1000/month, but I know what I’m getting.

***PSA*** for all my friends/family that use health sharing ministries. DO NOT USE Liberty Healthsare out of Canton Ohio. They advertise that if you pay them a fee every month, they will reimburse/pay your medical fees. I have faithfully paid my premiums for a year now. I went to the ER in April, and they have been saying a check is on the way since July for almost $10,000 to pay my medical bills, but the check still has not been sent. I call them every month and get the same generic response. I have since been sent to collections, because they told me the check had been mailed out. So instead of setting up a payment arrangement with the hospital, I counted on a check arriving because that’s what I was told. Still no check, and the collection agency calls me daily. I have never even been late on a bill in my life. I pay my bills, and have paid Liberty Healthshare $525 a month for over a year and they are not doing what they say they are going to do. If you google them, you can see that over the past several months they have really dropped the ball and are not paying medical bills anymore. When I signed up for this program I did research and even knew people who were happy with them and had used them in the past who were happy. I don’t know what happened, but I can tell you it’s NOT good. Samaritan Ministries was the best we have used, but Liberty claimed to help cover well visits so we wanted to give them a try. Never again. Stay far away. I have filed a complaint with the BBB and am looking at ways to get a refund on my $7,000 I have paid to them over the course of the past 15 months.

My family is having the same experience. We began using Liberty in January of 2019. We changed our sons pediatrician and our personal physicians to offices that are set up for direct billing. We began using our medical services and the offices told us that they would bill Liberty directly. Month after month we paid our “premium” and with an operation on our son, we meet our deductible. Well, this week we received our first collections letter stating that Liberty hasn’t paid for a single office visit for our son, dating back to January 2019. We are now waiting for letters to come in from our dr’s , the surgical center where our son had a procedure and the specialists office at CHOA where our son was seen by an endocrinologist. I beginning to realize that this whole ministry medishare is a complete sham. The administrators of these organizations are feeding us lies and pocketing every cent they can get their hands on. Unfortunately they are not regulated by the state Dept of Insurance but we will be filing a grievance with the Sec of State and the state Attorney General. My recommendation is to steer completely away from these organizations.

Liberty HealthShare is an absolute shame. Find another alternative. As an example: One wellness visits per year is claimed to be covered. False: In August my wife and I went for our Annual wellness exam. Our Dr., who is a Liberty Heathshare member Submitted the invoices as directed. It is now January and the Dr has not been paid. Our Dr. Finally gave up and sent us the bill. But that’s not all. Unfortunately, my wife had an incident with her heart and blood pressure near stroke conditions., it required An ER visit and emergency treatment. In 35 years of marriage we have only once needed an ER visit, so we are not people that just run off to the Dr’s or Hospital.

We submitted our bills as directed. $6000.00 later….nothing. A complete refusal to pay. Anything. My wife and I had to negotiate with the hospital a payment plan. It is a complete scam. For your heath and safety, do not join. Find another alternative or nothing at all is better than Liberty Heathshare.

Mike,

Submit a claim to BBB and they will jump on the case… If you are still contributing. I insisted that all my communications during the resolution be done over email so that there was a clear record of what they said. To give you a heads up, their internal policy is that if a doctor submits a claim and doesn’t put that you paid, then they will reprice (cover) only the medicare allowable rate, which is hardly half of the cost in many cases. It also takes forever when the provider sends the bill. Also, providers might forget to put the amount you already paid on the claim form because they normally haven’t received payment when they are submitting to actual insurance companies. You will get best results if you ignore their direction to have the provider submit the claim and just submit it yourself. But you will have to show proof of payment or the same policy (medicare allowable rate) applies. To sum up… They only cover the full cost if they have proof that it’s already paid, and it will be processed faster if you submit it instead of your provider. Oh, and keep following up with them or it falls down the cracks!

I have the same issues as above. They tell me my reimbursement has been approved and processed, but don’t know when it will be sent. This has been six months. Everyone I speak with says “I wish I could help, but I can’t”. I continue to ask for someone that can actually help. This is just shameful!

Interesting, I hadn’t heard much about these types of organizations before so I appreciate the review. Curious, is it available to buy in all 50 states or are there geographical restrictions? Thanks!

Beware. I have been with them for three years now. In 2018 they went downhill drastically. The “monthly share” price went up (over $100) and service plummeted. Customer service is non responsive and unhelpful. The inbox/share box website does not work. They do not respond to emails. I spend hours per month on the phone trying to decipher the statements, which conflict with what they show in my “share box”. I often have to take time off work to do this. They state they will reimburse me in 30 day, but I am still waiting for payments from May of 2018 and we are now in March of 2019! Still no reimbursement from them. At first, I thought it was a brilliant idea and had family members sign up. Over a year later, Liberty still has not sent the visa “gift” card they claim they will, even after multiple calls. They have deleted the “share” button on my inbox, so I cannot upload my new bills as of 2019. No one responds to my emails about this (which I have had to send through their website as my inbox email now has no option to send emails either! ) I have had to take time off work to spend hours on the phone with them about bills. I have dealt with waiting on hold and getting conflicting customer service answers from their reps. Often reps do no know answers to your questions and just quickly want to get you off the line. Liberty pay fractional amounts of my bills and I still owe. When you sign up, they claim they will allow you to see any provider. Not so. I have had to change doctors and sadly the new one already knew of them and their difficult reputation. It’s now awkward at the doctors office, as the staff hate dealing with them for payments. And I’m still left with bills that they claim they will reimburse. When talking to Liberty about the errors and problems, they claim its “too much growth..”. I don’t know about that, I’m wondering if its faulty management. So frustrating. I am looking elsewhere and told my family to cancel their plans. Its a good idea in theory, but somethings gone wrong in their practice.

I have had the same problems with them. They will not answer the phone and it takes them over two weeks to respond to emails. I have been trying to cancel my membership and can’t get through to anyone on the phone and there is no way to do it online. I have called several times waiting on hold for 30-40 minutes with no one answering. I finally hang up, not knowing if someone is actually there or ever going to answer. I finally talked to someone yesterday and they told me that they can’t refund me for my dues because I did not have it sent to them in writing in time for them to cancel. I talked to 3 supervisors and they told me I should have stayed on hold longer than 35 minutes. I am starting to think this is a big scam. I have had bills submitted to them since December. I had one of my doctor bills sent back to me saying they refused it because it was a pre-existing condition, it was for an ear infection. I don’t know how that is pre-existing. It is a terrible company now. I would not recommend them to anyone at this point.

Wow, sorry for your issues. We’re having a few struggles with some medical bills right now (no more so than with an insurance company, I would add), so I’ve been on the phone with them quite a bit. I’ve never waited on hold more than 5 minutes. In fact, somebody almost always answers on the first or second ring. Still, that has to be frustrating.

Come on Greg and Holly give an honest review for 2021…they are paying CEO 500,000 dollars in 2019…who knows about 2020 because you cannot see their 990 and no that is not the going rate more than double the Medishare and 4 times as much as most. They are paying to lobby 120,00 dollars a year and 250,00 for CPAC last year but are not paying claims.. they will tell you 18 months when you call in. They literally told my provider they do not have the money to pay my bill… I can email you the actual bill saying this and it was only 3K…I know you are likely gettting a referral bonus but seriously how can you as a Christian encourage people to join this company…

I have the same issues with Liberty. Have been a member for 4 years. They started off great, not they don’t pay bills for over a year in some cases. They always have an excuse! Buyer beware

Trust me you want to beware of this company. They grew too quickly. Their infrastructure is not adequate. Bills do not get paid. No one answers the phones. You are billed each month but they do not do any kind of job paying bills. And always have an excuse why it takes over a year to pay your bills. I am done with this company and their lies.

Thanks for the detailed review Holly. We’ve gone back and forth on joining something like Liberty. Our premiums are a bit over $700 month with a $12k deductible so there’s definitely opportunity for savings. My concern, and I’m likely being overly conservative, is the coverage is not unlimited as well as the resources someone like a major health insurer has is likely considerably more than a sharing ministry. That being said, something obviously has to change because spending this much on something that’s no better than fire insurance doesn’t make any sense.

I would advise you that your concerns are legitimate. A year and half ago after our premiums rose to the equivalent of a mortgage payment, we decided to go with Liberty HealthShare. Things were fine while we remained a healthy family and submitted little in the way of claims. Then early this year our teenage son became very ill, was hospitalized, and was diagnosed with Crohn’s disease. What has followed has been months of trying to get bills processed and countless phone calls to LHS. There seems to be little communication between departments and I have told my story a ridiculous number of times. As of today, all claims have now been processed correctly but still have not been paid. Providers are getting impatient with us. We are worried about the financial situation of this company and wonder if this is why payment is being held up. They have had several months of claims exceeding premiums according to their newsletters. And the cherry on the top? They are now declining to pay for my son to receive IV infusions of Remicade to keep his Crohn’s disease in remission. Biologics are the gold standard now for patients with autoimmune diseases and this drug is what is keeping my son out of the hospital. Most all carriers consider this a medical treatment, such as chemotherapy, but LHS has deemed it a “maintenance drug” which they don’t cover. So tread carefully here. If you or a loved one end up with a serious long term medical problem, you will be facing a situation like ours. We have a teenager who needs infusions that will cost approximately $40,000 per year and we have no coverage for that. Any commercial insurance carrier, as well as Medicare and Medicaid, would be covering this. Just want to share my story because we learned the hard way that LHS can label things however they want and you have no recourse as they are not regulated. We will be going back to traditional insurance when the open enrollment season comes up again at the end of the year.

Hi Brenda, I am so sorry that you are going through this and my prayers go out to you and your family, especially your Son and I pray that your bills get paid. However, I do want to say that just because an insurance company is regulated doesn’t necessarily mean that you will be covered and that they will pay for everything. My brother, who is in his 50’s has insurance through BlueCross and BlueShield. So you would think awww he has great insurance and if anything were to happen he would be covered, right? WRONG!!! My brother was diagnosed with Lymphoma cancer in his groin. They cannot operate because the swollen lymph node is right next to the main artery (I’m not even going to try and spell it) anyway it is too dangerous to operate. He has been undergoing chemotherapy off and on for over a year. Long story short, BlueCross will NOT pay for his chemotherapy!!!! Therefore, I must conclude that your statement, “Any commercial insurance carrier, as well as Medicare and Medicaid, would be covering this.” is not accurate. My brother has racked up well over $40k dollars in medical bills because a “major”, “regulated”, health insurance company refuses to cover his chemo, which he has to have because the cancer has not gone into remission. Just a heads up just because you pay thousands of dollars before an insurance company will even pay “anything” doesn’t mean they will cover everything when there is a serious medical issue. Also, insurance companies label their claims however they want as well, which is why they won’t cover my brother’s chemo!!!

Yes, you may have incidents where you have to work with insurance to get them to pay. But it never ever takes 18 months minimum to get paid back. People are going to collections… I literally think having Liberty is one of the worst financial decisions any family could make. If you have a claim you can almost guarantee you will go into collections…And when you call they will give you the run around and to make matters worse. The IRS 990 shows that they paid their CEO 500.000 dollars in 2019 while they were unable to pay claims in a timely basis…this is more than any other healtshare I could find….run run run

My personal experience was precisely the same. They offer zero answers to their extended wait times on payments. Collection agents begin destroying your credit. They use ridiculous canned language to explain that LHS is not insurance. They do not know how long it will take. Could be eternity. Money submitted is a gift and you really can’t expect anything at all in return for the gift on your donation. Biggest financial mistake of my entire life.

I have had an awful time with LHS. They don’t communicate well with me or each other. There are bills that show up, and I have no idea what they even are. Sometimes they have asked me to submit additional information, which I do, and they create a new bill which resets the clock. I am 5 months past a claim and it has not be paid and every time I call, I get excuses. I like the way it is structured, but it does not work I have never been so frustrated with health care issues.

My experience has been terrible too. They don’t send messages, they don’t advise if something is wrong until about 3 months later. They then ask for additional info- in my case actual medical records. This was an ongoing condition with a specialist so it clearly is all the same event. Honestly you better have a lot of money in the bank to risk maybe never getting reimbursed.

Beware that if you ever decide to cancel that you have to do it by the 20th of the month before, even though they don’t charge your card until around the 5th of the next month. If you try to cancel after that, they will hold you by their “RULE” and have no compassion if you have the money ” to donate” or not.

They are very uncompassionate considering they are a ministry organization.

Left a very sour taste in my mouth.

I would never go back.

Do not go with Liberty

Yep — same experience. Health Shares are NOT the answer so many hoped. You may save a few dollars up front only to be in the hole if you actually have a medical expense. Liberty Health MAY have good intentions, but they appear as nothing short of a scam.

My wife and I have been Liberty members for a couple years now and really haven’t had any claims until February of 2018. At that time, my wife turned in a little over $1,000.00 for treatment she received at a local clinic where both our PCP’s practice. Unfortunately, when the bills were submitted, Liberty marked this bill as a duplicate and only processed the bill for the $100 we have to pay each time we go to this clinic for treatment/ appointment because they don’t accept Liberty. That $100 went as part of our AUA which we expected. After a month or so of not seeing anything in our Sharebox relating to the larger bill we contacted Liberty. We were told the larger bill had to be sent back to be reprocessed. I could go on and on about this situation, but long story short Liberty still has not paid this bill. My wife called Liberty and advised them the clinic is going to send us to collections but was advised the bill is still in processing? She asked how long does it take to reprocess a bill. The rep told her they don’t have a time period any longer. So, here we are today with another notice from our provider asking us for the money and to contact them within 10 days. We just don’t know what to think about this whole process with Liberty. We shouldn’t have to wait over a year for Liberty to pay a bill. I’m not even going to start with a bill I submitted that was originally denied by Liberty because it needed pre authorization, when Liberty later found, after i called them, it did not need pre authorization. So, it was sent back for reprocessing. We wonder if it’s going to be another year or more to get this one taken care of. There is one thing Liberty has no trouble with and that is taking our monthly share amount from us. They’ve never had any problems doing that!

Other health shares get great current reviews but outside of Holly and Greg you will not find many positive reviews of Liberty ….

This is fascinating as the healthcare landscape is changing so quickly. I’m glad that my family and I are covered by my comprehensive employer plan because things are so complex.

This plan would make me nervous, I think, because it does have a cap on the payout. For me, the purpose of insurance is to cover you in case of a catastrophe. In this case, god forbid, you do have a major health catastrophe, it could still drive your family into bankruptcy, right?

That would make me nervous – on the other hand, I’m not paying the bills either, so you have to do what is right for you and your family!

Right now, that’s a very manageable risk. Since you can sign up for Obamacare three months out of the year, we could easily get a plan if we started getting close to our $1 million max.

What would make me more nervous (and upset) would be throwing $800 – $900 per month into the trash for a narrow network plan with a $12,000 or $13,000 deductible. I’ll take the risk. Chances are good we won’t accumulate $1 million in costs in a given year considering we haven’t had any healthcare costs to speak of our entire lives (other than when my kids were born).

I am seriously considering this plan. Just got my Obamacare renewal I will pay for a family of 5 with no health issues $2,063 a month with a HSA compliant deductible of $6500. I am so glad there are options out there. As far as the $1M limit is concerned I use to sell health insurance and every year the company shared their top 10 claims of the year. None ever hit over $1M the most expensives were premature babies and burn victims. Rarely did cancer or heart attacks reach the top 10. Now that was about 8 years ago but I feel comfortable with the $1M limit. Thanks for the info.

Hey Tommy! We were/are willing to take our chances with the $1 million cap, too. Definitely beats getting extorted! That $1 million only has to last until the next Obamacare enrollment period, too, since you can apply for a new ACA plan three months per year. So really, that 1 million per incident cap just needs to last 9 months at most.

Holly – Could you verify your comment, “…you can apply for a new ACA plan(Affordable Care Act/Obamacare) three months per year”? Unless you incur a “Qualifying Event” which makes you eligible for a “Special Enrollment” in the ACA, enrollment in an ACA plan (or any health insurance plan other than possibly a short term catastrophic plan) cannot be EFFECTIVE until Jan 1st of the subsequent year https://www.healthcare.gov/glossary/qualifying-life-event/. Thank you for clarification.

Remember, that is $1,000,000 cap per person, per incident! I called and discussed this at length with Liberty. Instead of paying $500/month on ACA with $10,000 deduc(plus tax penalty if I make more than what I stated), we can pay $449 and $1500 AUA amont!! Worth the savings and risks.

Holly, hope you don’t actually have to use it. There’s no way you’ll get to the cap because they’ll stop paying bills way before that.

We’ve used it multiple times without any issue thus far.

I do not know how you can in good conscience recommend Liberty Healthshare…they are taking over 12 months to pay claims have over 200 complaint as of today in the Attorney Generals office in Canton, Ohio…they told my provider they do not have the money to pay my 2500 dollar claim. I pay 400 dollars a month just for me…The Attorney General is sending me the 200+ complaints as they are public record. I would be happy to forward them to you when I get them….this company is not paying bills period. You are really steering people to wreck themselves it they have a huge claim…

So you seriously encourage people to go with Liberty when they are taking 18 months minimum to pay, Tell providers…and yes I have a bill that says this that they do not have the money to pay your bill even though it is approved for sharing and has been since July…um it is December and even though they cannot pay their customers bills they pay their CEO 500,000 dollars in 2019, spend 120,000 for lobbying and 250,000 to sponsot CPAC…seriously you can actually recommend them…such a great Christian Company

Seriously how can you as a Christian recommend a company that at their own admission is taking 18 months to pay bills but manages to pay their CEO 500,000 dollars in 2019, CPAC 250,000 dollars and 120,000 in lobbying expenses…people that is more than any other healthshare and a lot more than most… Run run run

I understand paying 100% until you’ve reached your out of pocket, but what happens after that? Do you have to pay and wait to be payed back, or do they pay your provider directly?

Thanks,

Tina

Actually wellness appointment me, Paps, and mammograms and colonoscopys are covered 100% without having to meet the 500.00 member allowance. But I have read where people went to the doctor and still had to pay and were not reimbursed. I am praying this doesn’t happen to me.

One nice thing about Liberty is that they will pay your provider directly.

Be prepared to wait 18 months at the minimum and that includes huge hospital bills that will go to collection… there are plenty of healtshares without this issue

Hi Holly, I am in the market for another health sharing plan. I currently have Medi-share but they raised the monthly amount. Anyways, I am reading reviews and seeing many complaints about bills not being paid. You can google search the reviews yourself and see. Here are some yelp reviews: https://www.yelp.com/biz/liberty-healthshare-canton-3 I would like LIberty HS to respond to the complaints. Everything looks good on the website; the numbers, the benefits and how it is supposed to work. I’m just concerned about the actual application. Thank you for any insight or comments.

Ha..there are plenty of responses…all explaining why the are not legally obligated to pay because they are not insurance

Hi Holly. I’m not sure how long ago you wrote this but since changes are now possible with the ACA are you concerned that soon you will not be able to sign up for insurance when you are reaching your 1 million dollar cap because the laws may change regarding pre-existing conditions? That seems like a concern and possibility to me. What do you think on that? Thanks. Catherine

Hi Catherine, I just updated this post in early October. Did you read it?

No, I am not worried about reaching the 1 million cap per illness considering we are healthy other than my daughter breaking her arm. I do not waste my time stressing over highly unlikely “what ifs.”

I love how you won’t reply to all the many, many people on your comments who Liberty won’t pay their bills.

I have over 1,000 articles on this website. Do you really think I have the time to reply to every single comment that comes along? Seriously?

Please remember I don’t work for Liberty. This is my personal review based on my personal experience. Anyone is welcome to leave a comment sharing theirs, but no, it is not my full-time job to reply to every person who doesn’t agree with something I have said.

Actually, Liberty’s Complete is 1 million dollars per incident, not per year. I have this plan and so do many others I know and have had it for many years. The bills are sent directly to liberty, they are paid. I have heard of some who said they took a while to pay, but what they found out was the provider (ie. hospital or doctor office), did not respond to Liberty’s request for the member’s medical history which is requested when it’s a serious condition or procedure. One of my friend’s had a triple bypass surgery and the bill was paid. That was one month after he joined. Overall, it’s far better for a family with a predominately healthy lifestyle and no major conditions. Traditional Health Insurance is for those with major medical and pre-existing conditions. Which I would advise Brenda she could easily put her son on Obamacare.

If you make a claim in 2021 that is more than a hundred or so dollars you can anticipate it taking a minimum of 12 months to get paid…that is straight from Liberty…if you have a major medical expense can your credit afford hundreds of thousands of dollars?

Holly, any update to your October 2018 post? Have you received payment?

My brother was diagnosed with cancer. He has BlueCross insurance through his employer. They WILL NOT pay for his chemo!!! You think just because you have great health insurance you are covered when a catastrophe occurs only to find out when that catastrophe actually happens, they won’t pay.

We belong to Liberty and I have no problems with it so far. It’s much more affordable, and it covers us even though we travel full-time, so it’s a win-win!

I have sold insurance in the past, and have been very impressed with Liberty Health Share. I have had zero problems using it at any medical facility. My brother is a top insurance salesman for a his company and he just signed up with Liberty.

Hi Michelle. How old is your post? I am concerned about all the reports of non payment in 2018. Have you made any claims?

If you make a claim in 2021 that is more than a hundred or so dollars you can anticipate it taking a minimum of 12 months to get paid…that is straight from Liberty…if you have a major medical expense can your credit afford hundreds of thousands of dollars?

This is surprising. I’ve looked into Liberty but there are so many very upset members on their Facebook page and their rating on BBB is so low. When I called they said they were Christian but any religion can join. Confusing.

This is what is concerning me as I consider joining. Have you had claims recently, and were they covered quickly?

We have had bills within the last 3 months (including lab bills, doctor bills, surgery center bills) and all have been shared “quickly” by LHS. We’ve had absolutely no problems thus far.

Wow you must have some connections because when you call Liberty they will flat out tell you they are currently paying bills 18 months out. I have a bill that has been approved for sharing since July it is now Dec and they will not even give me an idea…all were preapproved and all were coded correctly …. There are hundreds of complaints with the BBB over a 1000 and over 265 recent complaints with the Attorney General of Ohio …so tell us all Greg what do you do to get your bills paid quickly…inquiring minds want to know

We’ve had LHS for about a year and a half. Shortly after signing up, I had a medical emergency and subsequent surgery that ended up costing around $70K. Due to our LHS info not being inputted correctly at the hospital, the hospital did not bill Liberty, but instead sent us the bills. I sent them to Liberty. LHS negotiated the bills down with the hospital and after a couple of months paid all of the bills for the negotiated amounts minus our AUA. After that our children had a few doctor visits here or there and they were submitted directly by the doctor’s office to LHS and all were paid in the same way, with the exception of one of the bills. One of my sons had an eye emergency (the don’t cover regular eye doctor visits, but will cover medically necessary eye emergencies, surgeries, etc.). They paid all of his bills for his doctors and his procedures except the initial emergency bill. It has now been 8 months since that emergency and we are still waiting for the bill to be paid. Apparently instead of actually negotiating all of the bills with the medical providers, some of them they just adjust themselves at a percentage similar to what Medicaid would cover and send the provider that adjusted amount. In the case of this bill, LHS sent our provider a check for what amounted to about 40% of the bill with a provision that if it was accepted, that constituted payment in full. The provider sent LHS back the check because they were not willing to accept 40% of the bill as payment in full. By this time it had been several months and so the medical provider sent me the bill. I emailed it to Liberty and they told me that they had paid it but that the provider had rejected it. After going back and forth several times with both LHS and the provider, I finally found out what exactly had happened. LHS had me email the bill to their legal department at MedCost Solutions LLC. I did and after about a month, I was notified that they had not been able to successfully negotiate a discount for this bill so they would be paying it in full. It has now been over a month and we are still waiting for payment to be sent to the provider. I get weekly (sometimes more) calls from the provider asking about payment, and all I can tell them is that it was approve by LHS and they should get paid soon. I was also told by LHS & MedCost Solutions NOT to make any payments on it since that would jeopardize their ability to negotiate on my behalf or something like that.

Overall, we have mostly had really good experiences with Liberty, but apparently there can always be a glitch like this and everything does not always go smoothly. Also, in the last several months, apparently they have been getting more members and so it is now taking longer for bills to be paid because they said they are swamped. Also, LHS will only cover 1/2 of needed prescriptions for any covered expense.

If I had unlimited funds, maybe regular health insurance would be easier, I don’t know, but since I don’t, this has worked mostly very well for our family. Also, I like that our monthly payments are not going towards anything that we find morally objectionable.

Lately, it seems to take no less than three months, usually more, for bills to be shared. We just finally got a bill from last July shared and we currently have several bills from January that they say have been approved for sharing, but still not shared almost four months later.

They take about a month to pay for a small bill. If you have an emergency or hospital stay or anything they can remotely pick apart, then you’re in a lot of trouble. They have ABSOLUTELY ZERO ACCOUNTABILITY BY LAW TO PAY ANYTHING. And, they have no problem telling you this. Read the fine print. They did not write it without a purpose. In the end, they will lean on it. I joined a year and a half ago. I’m staring at $40,000 in bills that they won’t pay. Some are approved, some are not. Some are waiting for the doctor to send his fingerprint on a blood sample laced with holy water. It’s impossible to get them to pay anything. You can wait and talk to a thousand reps. It won’t matter. They do not pay after a few bills. It all stops. Legally, you can do nothing and they know it.

Kathleen, was your issue resolved? We are possibly in a similar situation with an unexpected hospitalization and thousands of dollars worth of bills. It’s still early but the impression I am getting so far is that I am on my own. Please let me know how ya’ll are doing.

Please notify the Attorney General of ohio it is easy to do and they are helpful also please file a complaint with the BBB we have to protect other people as well as advocate for ourselves. Thanks

We submitted 3 bills on the 4th of July and today is August 22nd and we have not received an update on the status. For now I am reserving judgment but we are getting nervous.

Hey Randall, we’ve submitted several requests to them before. Payment typically takes a few months, which is slow but not unusual when working with healthcare. You can always check with customer service as well.

Greg, the difference is that if you have traditional health insurance, when payment takes a few months, it is the health care provider that has floated the payment and it’s really of no concern to the policyholder. When you are self pay, you are the one advancing the payment and have to chase the health share for reimbursement.

In the case of your daughter’s broken arm which you estimate could come to $40,000 by the time all is said and done, are you prepared to advance that much on behalf of Liberty, and then wait to be reimbursed for months, with the outside possibility that they do not fully cover it? I don’t think there are many who would be ok with that. Folks are generally signing up with the health share in the first place because they do not have the means to easily afford traditional insurance.

That is actually not how it works at all. This is our 5th year with Liberty and we have never paid upfront and waited to be reimbursed. All our bills have been sent direct to Liberty (including a $10,000 surgery I had the year before last).

Holly, thanks for your reply. I’m happy that it is working well for you. However, as I’m reading more reviews of Liberty, I’m finding that many complain that this is the exact situation that they are in. Folks saying that Liberty just drags their feet attempting not to pay. Others saying that they’ve had to pay because Liberty takes so long that the provider/administrator was turning it over for collection. Still others indicating that their bills were in fact turned over for collection.

I have only read a handful of bad reviews for Liberty over the years and they almost all sounded like user error to me. Where are all these bad reviews you speak of?

There are a few on yelp. The Better Business Bureau has flagged Liberty because the issue is so frequent.

https://www.bbb.org/us/oh/canton/profile/private-health-services-plan/liberty-healthshare-0282-92006475/details#Pattern-of-Complaint

“BBB has noticed a pattern of complaints is beginning to exist concerning billing issues. Consumers allege there is a significant delay in receiving reimbursement for medical services. Often times, consumers are waiting over 90 days for reimbursement which is longer than the 45-60 day time frame consumers are being told by the company. Additionally consumers state confusion of medical services/procedures covered by the plan. ”

“Update: As of July 18, 2018, BBB has determined a pattern of complaints still exists. Since the BBB met with company representatives in April 2018, there have been 21 additional complaints and 10 negative customer reviews. “

Hmmm….I haven’t read about that yet. I will say they have paid a few of our bills fairly slow, as in over 3 months from beginning to end. It wasn’t a problem for us, but I did notice the slowness since I stay on top of things. Ultimately though, they paid.

Hi Greg,

Liberty Healthshare is a mess right now. Please do not delete this post. People need to know that 2 months is not realistic to be reimbursed. We paid out of pocket our bills and cannot get traction on our bills. (Bills were from service back in September and some even prior I believe). We have been patient with them as requested due to their training of new employees and system updates. Frustration for anyone submitting claims is likely from my vantage point and they need to stop accepting new clients until they can catch up with the ones they already have. I you do not have any claims you will be happy but if you have claims be prepared for frustration.

Holly and Greg,

Please take serious the BBB report. Part of a very long frustration for us is this. 1–Our maternity doctor facility would not bill Liberty and I believe it is due to their reputation. 2–Hence we had to pay our maternity expenses out of pocket. 3–We have submitted bills from our baby delivery which was in September as well as some invoices before. We were reimbursed for a few of the smaller bills but not any of the larger ones. The rep/manager we are working with seems overwhelmed and does not reach back out to us with updates as she has represented. We have been floating the money for months and months and months. If I were a doctor I would not bill directly to Liberty. Please reconsider who it is you have chosen to represent as I believe they have changed. They have some people working their with some big hearts who are great people but that will not rid your frustration as they have such a bureaucracy to get things paid that a big heart will only do so much.

I am an actual member (not employee) of LHS as of November 2015. My experience has been that they initially denied to reimburse me for a routine preventative scan I had in January 2016 on the grounds of a “pre-existing condition”. It took at least 3 months of playing the go-between for my care provider and LHS. I had to get a letter from my provider attesting to the lack of pre-existing symptoms. Once this was submitted, it was another couple months of waiting for the bill to go through their whole system again. Then it said payment pending… but no payment arrived! Apparently there was yet another glitch– more emails between me and customer service. Finally, 8 whole months after the scan I received reimbursement in full. Did I mention this was my first bill? Now I am 7 months pregnant (fortunately that happened after we were already members), and although Liberty claims they will cover pregnancy, I remain skeptical. A couple fees have been applied to my AUA, but the major bill from my midwife, though already submitted over a month ago, has yet to show progress.

A couple things I learned: The first tier service reps need more training– do not trust their answers to your questions as they often change or are pretty vague depending on whom you talk to. Push to speak with someone higher up. I actually stumbled upon an excellent, knowledgeable employee simply by submitting my questions through the “Contact Us” button on the website. I saved her email and she is my go-to for troubleshooting.

Secondly, MAKE SURE you or your doctor are submitting ITEMIZED, CODED bills, and receipt of payment if you pay out of pocket. If Liberty doesn’t know you paid OOP, they might discount the bill, and only credit your AUA with that amount, rather than the amount you actually forked out. Hope that made sense.

Finally, it seems Liberty is doing what they promised, but seeing as how their membership quintupled over the last 12 months, they are struggling to keep up in more ways then one. Patience seems to be key.

I just joined LHS a few months ago, have not been to the doctor yet and a few things I’m confused by. Also, the customer service is a mixed bag, can be hard to get a clear straight answer. I was lining up a office visit to a doctor for a minor thing and physical. I called a bunch of different local clinics with doctors. Most do not know who LHS. Two of them seemed to agree to bill them direct, a 3rd (a large hospital) said they would only bill me direct and I would have to get reimbursed.

Second thing I do not quite understand is how they negotiate bills. Will I pay more for medical care then if I had regular insurance? I am speaking of my first $500 of non-shared amount before they cover 100%. LHS is not contracted with and does not have pre-negotiated rates with health providers like insurance companies do. So I’m wondering since this is the case, will I be paying MORE for my healthcare because of this? Especially the first $500 that is out of my pocket? For example, a basic doctors visit may be $400. A insurance company that is contracted with that healthcare provide may have a pre-negotiated rate that discounts that by 60%. But with LHS will I have to pay that whole amount (until I hit $500)? I could not get a straight answer about this when I called customer service. You really do have to push to get someone knowledgeable.

I don’t think LHS does a good enough job of explaining how the billing works before you join. You are really on your own with it with trial and error. And I have my fingers crossed it will work.

Hey Thomas, Many billing departments are still mentally stuck in the “old” system and can’t seem to think outside it. If for some reason they aren’t willing to work with you, I just ask them to treat me as a cash pay customer. I also ask for a cash discount. If they give one, I’ll pay then. If not, I’ll wait until I get a bill. In the meantime, I’ll send my bills to LHS for reimbursement/to be counted toward my annual share amount.

As far as the negotiation, they simply negotiate a bills like an insurance company would. While medical cost sharing is not insurance, you should run the math to see how much you’re saving. In your scenario, even if you paid a full $400 visit as opposed to a highly discounted $160, that’s only a $240 difference. My guess is that you still come out way ahead choosing medical cost sharing over insurance. You’ll have to weigh that for yourself, but for our family, the math definitely made sense.

Greg do you work for LHS?

No, he doesn’t. Neither one of us do. We’re self-employed. My husband blogs for a living and I’m a professional writer.

I was about to sign up with Liberty Healthshare but decided to research them on the internet first and I am sure glad I did! I am not going to go with this health sharing ministry after all. I have read good things about Medi-Share and have met a couple of people on a forum I belong to that are happy with Medi-Share and don’t seem to have these extremely long payment issues. Funny thing, about a week ago I had given out my e-mail address to them for a “decision guide” and the rep called me every.single.day and left a voicemail every day also. Reading all these negative reviews here, on Yelp, on BBB, and two other blogs has changed my mind about going with them. They seem extremely eager to sign new people up but then they don’t come through.

So you think it is normal for 200 people have notified the Attorney General of the State of ohio to complain? that is not normal…it also is not normal for a company to tell your provider they do not have the money to pay your claim and I did everything by the book….I will be happy to provide you with the 200 complaints the attorney general has as they are a matter of public record and I have formally requested all of them. Go and look at the BBB page for Canton Ohio and you will find nothing but complaints…seriously if you have not found problems you are not looking. I just started this complaint process this week and I am in shock how many people owe hundreds of thousands of dollars that Liberty is not paying…I will be happy to sent you any documentation you would like believe me I do not set out on a quest like this without covering my behind

So you are telling me that you recommend a company that takes 18 months to pay, pays their CEOn 500,000 dollars which is more than double any other healtshare I can find, paid 250,000 to sponsor cpac and 120,000 in lobbying expenses all in 2019…I cannot tell you about 2020 because the IRS had not published it yet and they are refusing my requests to see it even though they are required to show it to anyone who asks….geez people do your homework do not ruin your finances

Hi Meagan, thank you for sharing! Could you please update on your pregnancy bills if it was paid or not by Liberty. Any challanges you had with them or maybe non. We are planning on having a baby and I was very concern how it will work with LHS. Any output will help. Thanks, Olga

Meagan, please share the name and contact information (phone # and/or email address) of your LHS “Go To” person! Inquiring s need to know!

*minds want to know

Which BBB site would you find them on? Aren’t BBB reports local (city) based?

https://www.bbb.org/us/oh/canton/profile/health-sharing-ministries/liberty-healthshare-0282-92006475/details#Pattern-of-Complaint

I had to be hospitalized for 5 weeks at the end of my pregnancy due to a partial rupture of amniotic sac. Baby was also in NICU for 2.5 weeks. I have excellent low cost coverage for myself (through work) but when adding son for that NICU stay, I did have to pay $700/ month for two months of insurance (as work only covers employee) before he could get on CHIP in Pennsylvania (no income limits for CHIP here, I pay full premium of $127/month). Have you heard of people’s experiences with child birth and hospital stays with Liberty? Being that my situation was completely unplanned and docs found no cause, I’d be curious how a health care ministry handles something like that.

I read Liberty isn’t available in Pa.

Health Sharing ministries are just going to get more and more popular. None of the major insurers made any money and it looks like the losses are getting closer to $750M – $1B combined. Even the biggest insurer still in the game will see breaking even in 2017 as a big win. Obamacare really can’t continue like this where insurers are losing hundreds of millions while premiums and deductibles are already very unaffordable for families.