Betterment Review: An “Easy Button” for Retirement Savings

This article may contain references to some of our advertising partners. Should you click on these links, we may be compensated. For more about our advertising policies, read our full disclosure statement here.

In this Betterment review, we’ll explain what Betterment is, explore how it works, and help you decide whether it’s a good fit for your retirement investing plans.

Do you hate high fees? Do you hate conflicts of interest? Do you prefer a do-it-yourself approach to retirement but want a little bit of guidance along the way?

If so, Betterment may be just the thing you’re looking for!

How Does Betterment Work?

So, what is Betterment?

I like to think of Betterment as an “easy button” for online retirement investing. Through their automated investment software, they help you create a balanced and diversified retirement account while drastically reducing your costs.

After you complete the initial interview and account setup, Betterment will create an investment plan that is tailored to your personal goals and time horizon. You have the option to adjust Betterment’s recommendations at any time, but other than that, the entire process is entirely automated. This makes investing for beginners and the “Average Joe” extremely simple and cost-efficient. Just set it and (basically) forget it.

Betterment Features

- Free to open account

- No minimum balance requirements

- Low fee structure

- Automatic deposits

- Automated portfolio rebalancing

- Customized portfolio allocation

- SmartDeposit

- Goal setting

- Tax loss harvesting

- Passive investing approach

- Choose your risk tolerance

- Retirement income tool

- Retirement guide tool

- Automatic dividend reinvestment

- Ability to invest fractional shares

- Charitable giving options

- 401(k) plan for businesses

Types of Accounts Supported

- Traditional & Roth IRAs

- SEP IRAs

- Rollover IRAs

- Individual & joint taxable accounts

- Trusts

- Non-Profit

Fee Structure

Betterment has changed its fee structure to make it even easier for the average person to start investing. They offer two tiers of service, both charging a flat annual fee on your total account balance. Here’s how it breaks down:

- Digital Plan: 0.25% per year on balances below $2M ($0 minimum balance); 0.15% on portions of balance above $2M

- Premium Plan: 0.40% per year on balances below $2M; 0.30% on portions of balance above $2M ($100,000 minimum balance required for either tier)

Also, Betterment does not charge additional trading or transfer fees. They even allow for unlimited rebalancing of your portfolio at no additional charge.

Registration/Regulation

Betterment is registered as a Registered Investment Advisor (RIA) through the U.S. Securities and Exchange Commission (SEC). Betterment Securities is regulated as a broker-dealer through both the Financial Industry Regulatory Authority, Inc. (FINRA) and the SEC.

Security

According to their website, Betterment takes bank-level security measures throughout their business, including browser encryption, two-factor authentication, and much more. This isn’t some “fly by night” organization! They use secure servers, identity verification, and the strongest available browser encryption. Additionally, any Betterment account you open (IRA, Roth IRA, SEP, etc.) is protected by the Securities Investor Protection Corporation for up to $500,000. Furthermore, customer money is kept completely separate from company funds. So, in the very unlikely event that Betterment was to close, you would simply transfer your investments to a new broker.

Why Should You Consider Betterment?

In his February 2018 annual letter to shareholders, Warren Buffett said, “Performance comes, performance goes. Fees never falter.”

Personally, I think he hit the nail on the head.

While having somebody manage your investments will always cost some money, many of the fees investors pay are outrageous. For those who don’t know better, these fees could be costing you tens of thousands – even hundreds of thousands – of dollars over the life of your retirement account.

Does that sound worth it to you?

Performance comes and performance goes. You can’t control the market. What you can control is how much you’re paying in fees.

That’s why I prefer to save my money in low-cost investments like index funds and exchange-traded funds (ETFs). These types of investments provide the same type of diversification as mutual funds but with much lower fees.

Any good Registered Investment Advisor (RIA) can help you set up your retirement account using ETFs and index funds. But, if you’re looking for the lowest fees, the best option is always to do it yourself.

If that option seems a bit scary to you, don’t worry. That’s where Betterment comes in!

With Betterment, you get the best of both worlds: You’ll get some investing guidance at do-it-yourself prices. Plus, it’s totally automated, which makes investing with them super easy.

What Does Betterment Do?

According to Forbes, Betterment now serves over 250,000 customers investing more than $8.5 billion. Their goal is to give you personalized investment advice that you can implement immediately. Through the use of automated software, Betterment is able to lower fees and reduce any tax consequences. This combination of low fees and automated adjustments helps provide you with the best possible returns.

Because Betterment automates pretty much everything, you can be as hands-off as you’d like. I like this approach because it helps you avoid making emotional decisions. However, if you’d like more control, simply adjust your settings.

Betterment’s Top Features

Investing Made Simple

By far, the biggest benefit to using Betterment is that it makes do-it-yourself investing a snap for investors at any level. Once you complete the initial interview, Betterment can handle all of your long-term investing needs for you.

The entire process is automated, making it super simple to get the most out of your retirement investments with the least amount of effort. With automatic deposits, tax loss harvesting, and automated portfolio rebalancing, Betterment practically lets you “set it and forget it.”

Optimized, Diversified, and Personalized Portfolio

Along with automation, the other major reason that Betterment is able to keep your costs down is because they invest your money into low-cost ETFs. This provides you with two major advantages.

First, these types of funds carry far fewer expenses than traditional mutual funds, which can mean thousands of dollars in your pocket over the long-term. Second, like mutual funds, each ETF is made up of numerous securities that are designed to mimic a particular index. This provides you with instant diversification within a certain category.

Rather than trying to beat the market, which very few people can do on a consistent basis, these funds are designed to follow the market’s ups and downs. If you stick with them, your returns should pretty much mimic the performance of the chosen index as a whole.

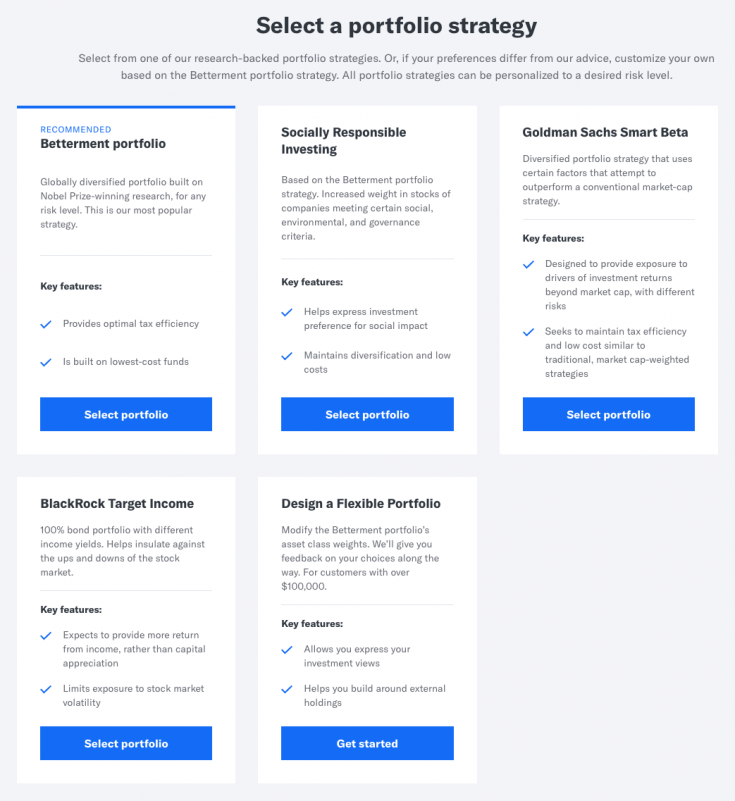

If you open a Betterment account now, one of the coolest things they’ll do is personalize your investing experience. Rather than just toss you into some random funds, Betterment’s software makes recommendations based on the answers you give in your initial interview. They will select investments from both stock market ETFs and bond ETFs. Again, they’ll allocate your assets in a way that provides you with diversification and exposure to a variety of different industries, both domestically and internationally.

SmartDeposit

SmartDeposit is definitely one of the best additions to the Betterment toolkit. With SmartDeposit, Betterment helps you put your extra money to work by saving it before you spend it.

Once you get it set up, Betterment checks your bank account once a week for extra cash. If they find any, they will invest that money for you, helping you to get the best returns on your money and grow your nest egg quickly.

To use SmartDeposit, just connect your bank account to Betterment. Then, set a “threshold” amount so that SmartDeposit never leaves you with less money than you need. Easy peasy!

Goal Setting

Another excellent feature offered by Betterment is that their software gives you the ability to save for certain goals. During the initial interview process, you can identify certain financial goals and save for them separately. In addition to saving for retirement, you can set up savings accounts for college, weddings, or other big purchases. It’s a pretty sweet feature, and one that I’d recommend you take advantage of.

Other Features of Note

- Automatic deposits

- Automatic portfolio rebalancing

- Automatic dividend reinvestment

- Fractional share investing

Fees at Betterment

One of the things I love about Betterment is that their fees are very straightforward and easy to understand. There are no trading fees and no account minimums for their basic Digital Plan. (Premium Plans have a minimum balance requirement of $100,000.) There are no transaction fees and no rebalancing fees either.

You are charged a flat fee based on how much personalized access you want. That’s it. For Digital Plans, you’ll pay an annual fee of 0.25% of your balance below $2 million. You’ll get a 10% discount for any money you invest with them above $2 million – meaning you’ll be charged 0.15% on every dollar invested with them above $2M.

The fee for the Premium Plan is a flat 0.15% above what you’d pay on the Digital Plan. That breaks down to 0.40% on every dollar below $2M and 0.30% on your balance above $2M.

Advantages of Betterment

Low Management Fees – As we just talked about, Betterment’s low management fees are totes attractive! Because everything that Betterment does is automated, they can keep their costs low – which means more money for you. With fees either as low as 0.25% or 0.40% of your total investment balance, you’ll be hard-pressed to find a better deal from a traditional advisor.

Multiple Investment Options – Although Betterment does not offer the option of investing in single stocks, they do offer a wide array of investment options that are totally suitable for most investors. Most people are going to want to take a look at the traditional and Roth IRAs, although they do offer taxable accounts as well. Personally, I love that Betterment has a SEP IRA option. It’s a great way for self-employed people to be able to fund their own retirement and get a little bit of investing advice without going broke.

Tax Loss Harvesting – Like most online advisors, Betterment does provide tax loss harvesting on taxable accounts. (Tax advantaged accounts like IRAs are not affected because they have tax advantages that are already built in.) In very basic terms, Betterment will sell off any investments that have lost value first, offsetting any gains you may have experienced and – thus – reducing your tax bill. Betterment’s software completes this automatically without any additional effort from you.

No Account Minimums – You can open a Betterment account now for free, and there are no minimum balance requirements on the Digital Plan.

Disadvantages of Betterment

No Solo Stocks – When you invest your money with Betterment, you are basically agreeing to take part in a “buy and hold” approach. For most people, this is probably the best way to invest your money anyway. However, if you would like to invest in individual stocks, you don’t have that option here.

Not Much Investor Control – Clearly, automating the investing process is one of Betterment’s biggest advantages, but it can also be one of its biggest disadvantages. Because of the nature of automation, individual investors don’t have a lot of control over which investments they are buying. Betterment will make recommendations from their list of stock and bond ETFs. You’re able to select out of those options and adjust the allocation if you wish. However, that is about as much control as you’ll get. If you want to invest outside of Betterment’s options, you’ll need to open an additional brokerage account somewhere else.

Doesn’t Plan with Outside Accounts – Like most robo-advisors, the basic Digital Plan with Betterment doesn’t include outside accounts into your long-term investment plan. However, the Premium Plan does allow you to include these assets into your planning.

Who Should Use Betterment?

- Buy and Hold Investors – If you are looking to open a retirement account that is easy to manage, Betterment may be a great fit for you. Betterment’s biggest advantage is that it allows long-term investors the ability to passively plan for their retirement. You literally have the option to “set it and forget it.”

- Self-Employed Investors – Self-employed individuals need to save for retirement completely on their own. That is what makes a SEP IRA so attractive. The addition of SEP IRA functionality makes Betterment a great place for busy self-employed people to invest. You’re able to receive investment advice, at minimal cost, and save time through the automated nature of the site. It’s fantastic!

- DIYers, Value Seekers, Millennials, and Skeptics – If you’re somebody who is skeptical of high-priced investment advisors or who wants to do it yourself (with a little bit of help), Betterment is a great option. Betterment gives you a ton of bang for your buck, giving you investment advice at bargain prices. All you have to do is provide Betterment with your intended goals, and they’ll handle the rest for you. Millennials, Gen Xers, and others who are remotely tech savvy are a perfect fit for Betterment. Additionally, there are no account minimums, so the entry barrier is very low.

Who Should Avoid Betterment?

Although I think Betterment is a great place for many long-term investors, it may not be right for everybody.

If you are somebody who needs constant reassurance and personal attention, Betterment may not be a good option. Likewise, if you are a highly emotional investor, you may want to spend a little more and hire a human advisor instead.

Automated systems like Betterment are not going to be able to talk you off the ledge when disaster strikes the market. Speaking with an individual advisor who can guide you through the rough times could cost you more upfront but save you thousands in the end. If you decide you need a human advisor, I’d highly recommend speaking with a fee-based RIA rather than a commission-based salesman.

Additionally, you should remember that Betterment’s over-arching investment strategy takes a “buy and hold” approach. This is great for long-term investors, like those who are investing in retirement accounts. However, if you are looking to trade individual stocks or funds, Betterment is not your place. Instead, you should try a brokerage house to make your trades.

Finally, if you are a seasoned investor looking to completely do it yourself, you’ll find lower fees elsewhere. Those who have the knowledge and the skills to properly implement their own asset allocation strategies really don’t need a service like Betterment.

Betterment Review: The Bottom Line

For my money, Betterment is one of the best robo-advisors around.

Betterment makes everything about investing simple. The best part is that the entire process is automated, allowing you to plan it and forget. From their easy 5-minute sign up to their automatic dividend reinvestment, Betterment helps you make the best decisions for your retirement investments.

Further, automatic features like SmartDeposit can help you put your money to work before you can spend it. It’s a great feature that can really help you maximize your retirement savings!

I hope that you’ve found this Betterment review helpful and informative! Please feel free to ask me any questions you might have.

Betterment Review

-

Commissions & Fees

-

Ease of Use

-

Range of Product Offerings

Overall

Betterment Review

Betterment is one of the best robo-advisors around. It makes everything about investing simple. The best part is that the entire process is automated, allowing you to plan it and forget. From their easy 5-minute sign up to their automatic dividend reinvestment, Betterment helps you make the best decisions for your retirement investments.

Further, automatic features like SmartDeposit can help you put your money to work before you can spend it. Betterment is a robo-advisor, though, which means you can’t invest in individual stocks, and you don’t have control over which stocks are chosen. But for buy-and-hold investors, Betterment is a great fit.

I use Betterment! I love that it has no account minimums and basically does all the work for you when it comes to investing.

Right? It’s a great way to make retirement investing super simple.

I have a betterment account but haven’t started using it just yet, I’m looking to increase my income first. What is most appealing to me is the automated savings and the low management fees $3.00/month is nothing to grow your money. I can’t wait to start investing, I was so intimidated before and now I feel like it’s effortless.

Awesome! I’m glad you’re feeling confident. And you’re right, $3 per month is nothing…provided you have more than $100 in there.

Really interesting to read this. We don’t have such options in the UK. Sure, the “robo advice” thing is on its way but still in infancy at the moment. I know a lot of people are interested in finding a simplified investing experience, and your review makes this sound like something a lot of folks here would want.

It’s a great service and I’ve been a customer since 2013. Their past performance numbers stack up with the best.

I would like to speak to you both. I’m starting out in real estate. My employer just downsized. And I didnt make the cut. Have a little bit. Wanting to learn more. Want my current funds available to invest to retain what my income was and way beyond. Just sent paperwork in for LLC.